What Category Of Forecasting Techniques Uses Managerial Judgment In Lieu Of Numerical Data

3 Forecasting

- What is forecasting and why is information technology of import?

- Empathize the differences between qualitative and quantitative forecasting.

- Describe types of need patterns exhibited in product demand.

- Calculate forecasts using time series assay and seasonal index.

- Determine forecast accuracy.

Forecasting is the process of making predictions of the futurity based on past and present data. This is nearly commonly by analysis of trends. A commonplace example might exist estimation of some variable of involvement at some specified hereafter date. Prediction is a similar, but more than full general term. Both might refer to formal statistical methods employing fourth dimension series, cross-sectional or longitudinal data, or alternatively to less formal judgmental methods. Usage tin can differ betwixt areas of application: for case, in hydrology, the terms "forecast" and "forecasting" are sometimes reserved for estimates of values at certain specific time to come times, while the term "prediction" is used for more full general estimates, such as the number of times floods will occur over a long period.

Adventure and uncertainty are fundamental to forecasting and prediction; it is generally considered good practice to signal the degree of uncertainty fastened to specific forecasts. In any case, the data must exist upwardly to engagement in order for the forecast to be as accurate as possible. In some cases, the data used to predict the variable of interest is itself forecasted.[1]

As discussed in the previous chapter, functional strategies need to exist aligned and supportive to the higher level corporate strategy of the organization. 1 of these functional areas is marketing. Creating marketing strategy is not a single event, nor is the implementation of marketing strategy something only the marketing department has to worry about.

When the strategy is implemented, the residue of the company must be poised to bargain with the consequences. An of import component in this implementation is the sales forecast, which is the estimate of how much the company will actually sell. The remainder of the company must then exist geared upward (or downwards) to run into that demand. In this module, we explore forecasting in more detail, as there are many choices that can be made in developing a forecast.

Accuracy is of import when it comes to forecasts. If executives overestimate the demand for a product, the company could end upwardly spending money on manufacturing, distribution, and servicing activities it won't need. Data Bear upon, a software developer, recently overestimated the need for ane of its new products. Because the sales of the product didn't meet projections, Data Impact lacked the cash bachelor to pay its vendors, utility providers, and others. Employees had to be terminated in many areas of the firm to trim costs.

Underestimating need tin can be just as devastating. When a visitor introduces a new product, it launches marketing and sales campaigns to create demand for information technology. But if the visitor isn't ready to deliver the amount of the product the market demands, so other competitors tin steal sales the firm might otherwise accept captured. Sony'southward inability to evangelize the east-Reader in sufficient numbers made Amazon's Kindle more readily accepted in the market; other features and then gave the Kindle an reward that Sony is finding difficult to overcome.

The firm has to do more than simply forecast the company's sales. The process tin can be complex, considering how much the company tin sell will depend on many factors such as how much the product will cost, how competitors will react, so along. Each of these factors has to exist taken into account in guild to determine how much the visitor is likely to sell. As factors change, the forecast has to change too. Thus, a sales forecast is actually a composite of a number of estimates and has to be dynamic as those other estimates change.

A common get-go pace is to determine market potential, or total industry-wide sales expected in a particular product category for the fourth dimension catamenia of interest. (The fourth dimension period of interest might be the coming yr, quarter, month, or some other fourth dimension period.) Some marketing research companies, such as Nielsen, Gartner, and others, approximate the market place potential for diverse products so sell that research to companies that produce those products.

Once the firm has an idea of the marketplace potential, the company's sales potential can be estimated. A business firm'southward sales potential is the maximum full revenue it hopes to generate from a product or the number of units of it the company can hope to sell. The sales potential for the production is typically represented as a percentage of its market place potential and equivalent to the company'due south estimated maximum market share for the time period. In your budget, yous'll desire to forecast the revenues earned from the production confronting the marketplace potential, likewise every bit against the product's costs.[ii]

Forecasting Horizons

Long term forecasting tends to be completed at high levels in the organization. The time frame is mostly considered longer than 2 years into the hereafter. Detailed cognition nearly the products and markets are required due to the high degree of dubiousness. This is commonly the example with new products inbound the market, emerging new technologies and opening new facilities. Often no historical data is bachelor.

Medium term forecasting tends to exist several months up to 2 years into the future and is referred to as intermediate term. Both quantitative and qualitative forecasting may exist used in this time frame.

Short term forecasting is daily up to months in the hereafter. These forecasts are used for operational decision making such as inventory planning, ordering and scheduling of the workforce. Unremarkably quantitative methods such as time series assay are used in this time frame.

Categories of Forecasting Methods

Qualitative Forecasting

Qualitative forecasting techniques are subjective, based on the stance and judgment of consumers and experts; they are appropriate when past data are not available. They are usually practical to intermediate- or long-range decisions.

In the following, we discuss some examples of qualitative forecasting techniques:

Executive Judgement (Top Downwards)

Groups of loftier-level executives will oft presume responsibility for the forecast. They will collaborate to examine market data and look at future trends for the business concern. Often, they will use statistical models besides as market experts to arrive at a forecast.

Sales Strength Opinions (Bottom up)

The sales force in a concern are those persons most shut to the customers. Their opinions are of loftier value. Often the sales force personnel are asked to give their future projections for their area or territory. Once all of those are reviewed, they may be combined to form an overall forecast for district or region.

Delphi Method

This method was created past the Rand Corporation in the 1950s. A group of experts are recruited to participate in a forecast. The administrator of the forecast volition send out a series of questionnaires and ask for inputs and justifications. These responses will be collated and sent out once more to allow respondents to evaluate and conform their answers. A key attribute of the Delphi method is that the responses are anonymous, respondents do not have any knowledge about what information has come from which sources. That permits all of the opinions to exist given equal consideration. The set of questionnaires volition go dorsum and forth multiple times until a forecast is agreed upon.

Market Surveys

Some organizations will employ market inquiry firms to solicit information from consumers regarding opinions on products and future purchasing plans.

Quantitative Forecasting

Quantitative forecasting models are used to forecast hereafter data every bit a function of past data. They are appropriate to use when by numerical data is bachelor and when it is reasonable to assume that some of the patterns in the data are expected to go on into the futurity. These methods are usually applied to brusque- or intermediate-range decisions. Some examples of quantitative forecasting methods are causal (econometric) forecasting methods, final catamenia demand (naïve), simple and weighted Northward-Period moving averages and simple exponential smoothing, which are categorizes as time-series methods. Quantitative forecasting models are often judged confronting each other by comparing their accuracy performance measures. Some of these measures include Mean Absolute Departure (MAD), Mean Squared Error (MSE), and Mean Absolute Percentage Fault (MAPE).

Nosotros will elaborate on some of these forecasting methods and the accurateness measure in the following sections.[3]

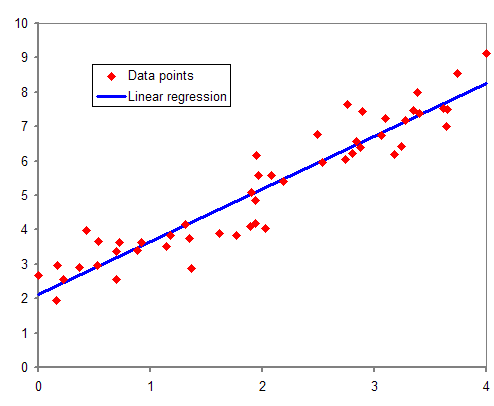

Causal (Econometric) Forecasting Methods (Degree)

Some forecasting methods try to identify the underlying factors that might influence the variable that is being forecast. For example, including information about climate patterns might improve the power of a model to predict umbrella sales. Forecasting models often have business relationship of regular seasonal variations. In addition to climate, such variations can also exist due to holidays and customs: for example, one might predict that sales of college football game dress will be higher during the football season than during the off-season.

Several informal methods used in causal forecasting do not rely solely on the output of mathematical algorithms, only instead use the judgment of the forecaster. Some forecasts have account of by relationships between variables: if 1 variable has, for example, been approximately linearly related to some other for a long menses of time, it may be appropriate to extrapolate such a relationship into the future, without necessarily agreement the reasons for the human relationship.

One of the most famous causal models is regression analysis. In statistical modeling, regression analysis is a fix of statistical processes for estimating the relationships amidst variables. It includes many techniques for modeling and analyzing several variables, when the focus is on the relationship between a dependent variable and one or more independent variables (or 'predictors'). More specifically, regression analysis helps one understand how the typical value of the dependent variable (or 'criterion variable') changes when whatever 1 of the independent variables is varied, while the other contained variables are held fixed.

- Forecasts are rarely, if ever, perfect. It is near impossible to 100% accurately estimate what the future will hold. Firms need to sympathize and expect some error in their forecasts.

- Forecasts tend to be more authentic for groups of items than for individual items in the group. The popular Fitbit may be producing six dissimilar models. Each model may be offered in several different colours. Each of those colours may come in small, large and extra large. The forecast for each model will be far more accurate than the forecast for each specific terminate item.

- Forecast accuracy will tend to decrease every bit the time horizon increases. The farther away the forecast is from the current appointment, the more doubtfulness it will contain.

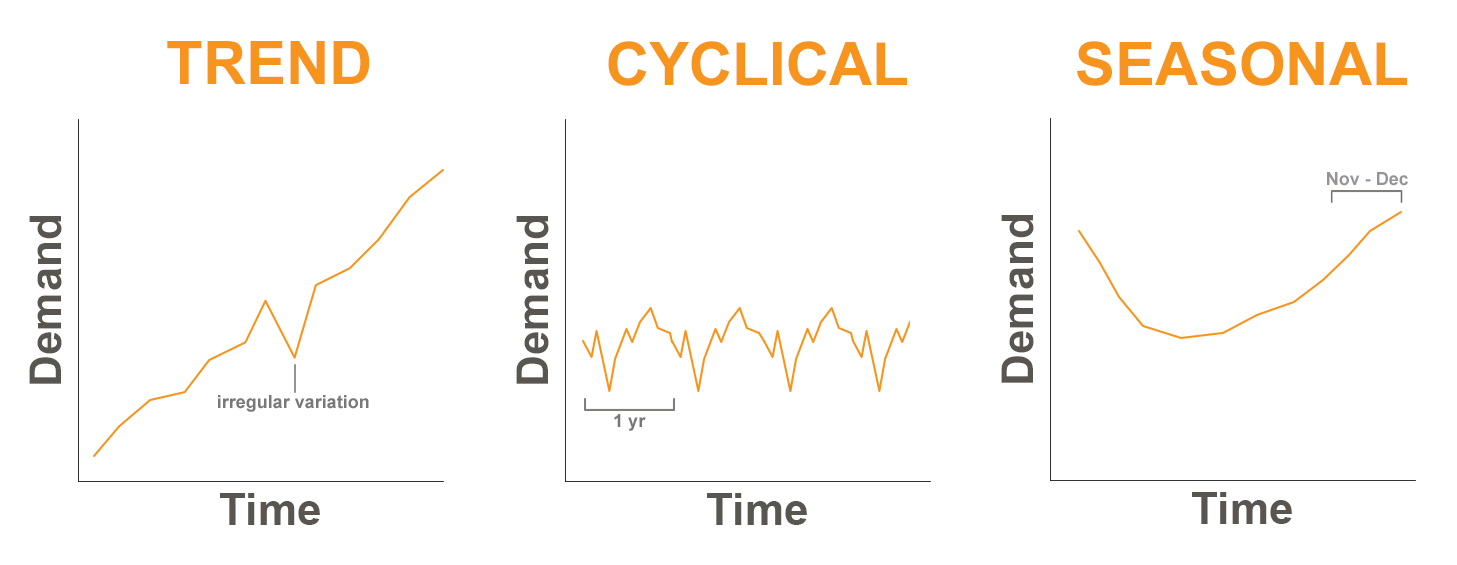

Demand Patterns

When we plot our historical product demand, the following patterns can oftentimes be constitute:

Trend – A trend is consistent upwards or downward movement of the demand. This may be related to the product'south life bike.

Cycle – A bike is a design in the data that tends to last more than one year in duration. Often, they are related to events such as interest rates, the political climate, consumer conviction or other market factors.

Seasonal – Many products have a seasonal pattern, generally predictable changes in demand that are recurring every year. Fashion products and sporting goods are heavily influenced by seasonality.

Irregular variations – Oftentimes need can exist influenced by an event or series of events that are not expected to be repeated in the future. Examples might include an farthermost weather result, a strike at a college campus, or a power outage.

Random variations – Random variations are the unexplained variations in need that remain after all other factors are considered. Often this is referred to every bit noise.

Time Serial Methods

Fourth dimension series methods use historical information as the basis of estimating future outcomes. A time series is a series of data points indexed (or listed or graphed) in time order. Most ordinarily, a time serial is a sequence taken at successive equally spaced points in time. Thus, it is a sequence of discrete-time data. Examples of fourth dimension serial are heights of body of water tides, counts of sunspots, and the daily closing value of the Dow Jones Industrial Average.

Time serial are very frequently plotted via line charts. Time series are used in statistics, indicate processing, pattern recognition, econometrics, mathematical finance, atmospheric condition forecasting, convulsion prediction, electroencephalography, control engineering science, astronomy, communications engineering science, and largely in whatsoever domain of technology and applied science which involves temporal measurements.[4]

In the post-obit, we will elaborate more than on some of the simpler time-series methods and go over some numerical examples.

Naïve Method

The simplest forecasting method is the naïve method. In this case, the forecast for the next period is set at the bodily need for the previous catamenia. This method of forecasting may often be used equally a benchmark in order to evaluate and compare other forecast methods.

Simple Moving Average

In this method, nosotros accept the boilerplate of the last "n" periods and use that as the forecast for the adjacent menstruation. The value of "northward" can be defined past the management in order to achieve a more accurate forecast. For case, a manager may decide to use the demand values from the last 4 periods (i.eastward., n = 4) to calculate the 4-catamenia moving average forecast for the next catamenia.

Example

Some relevant notation:

Dt = Actual demand observed in period t

Ft = Forecast for period t

Using the following table, calculate the forecast for period 5 based on a 3-flow moving average.

Solution

Forecast for menstruum 5 = F5 = (D4 + D3 + D2) / three = (forty + 34 + 37) / three = 111 / iii = 37

Weighted Moving Average

This method is the aforementioned as the simple moving average with the addition of a weight for each one of the last "n" periods. In practice, these weights demand to be determined in a fashion to produce the most authentic forecast. Allow'due south have a look at the same example, but this fourth dimension, with weights:

Example

| Period | Actual Demand | Weight |

| 1 | 42 | |

| 2 | 37 | 0.2 |

| 3 | 34 | 0.3 |

| four | xl | 0.5 |

S olution

Forecast for menstruation 5 = F5 = (0.5 10 D4 + 0.3 10 D3 + 0.2 x D2) = (0.5 ten forty+ 0.3 x 34 + 0.2 x 37) = 37.six

Note that if the sum of all the weights were non equal to ane, this number above had to be divided past the sum of all the weights to become the correct weighted moving average.

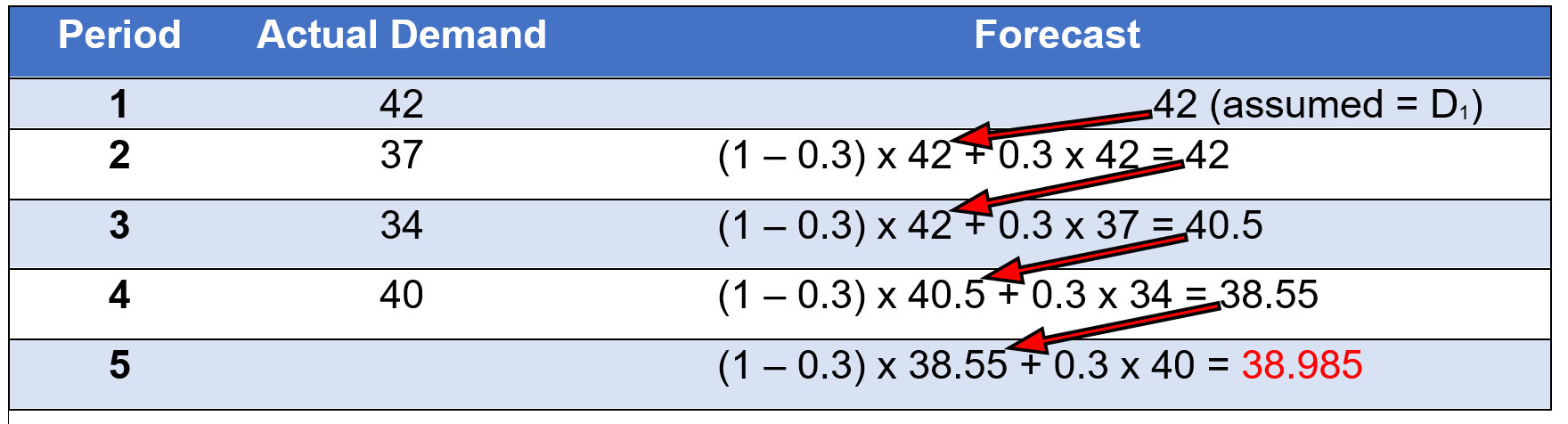

Exponential Smoothing

This method uses a combination of the final bodily demand and the last forecast to produce the forecast for the next catamenia. There are a number of advantages to using this method. It can often result in a more authentic forecast. It is an piece of cake method that enables forecasts to quickly react to new trends or changes. A benefit to exponential smoothing is that it does not crave a large amount of historical information. Exponential smoothing requires the employ of a smoothing coefficient called Alpha (α). The Alpha that is chosen volition determines how quickly the forecast responds to changes in need. It is also referred to as the Smoothing Cistron.

There are two versions of the aforementioned formula for computing the exponential smoothing.

Hither is version #1:

Ft = (ane – α) Ft-ane + α D t-1

Note that α is a coefficient betwixt 0 and one

For this method to work, nosotros need to have the forecast for the previous period. This forecast is assumed to be obtained using the aforementioned exponential smoothing method. If there were no previous period forecast for whatsoever of the past periods, we will need to initiate this method of forecasting by making some assumptions. This is explained in the next instance.

Case

| Menstruum | Actual Demand | Forecast |

| 1 | 42 | |

| 2 | 37 | |

| 3 | 34 | |

| iv | 40 | |

| 5 |

In this instance, catamenia 5 is our next menses for which we are looking for a forecast. In guild to have that, nosotros will need the forecast for the terminal flow (i.e., period iv). Simply there is no forecast given for menstruation 4. Thus, we will need to calculate the forecast for period 4 first. However, a similar issue exists for period four, since we practise not have the forecast for period 3. So, we need to go back for ane more menses and calculate the forecast for menses 3. As y'all run across, this will have us all the manner back to flow i. Because there is no period earlier menses 1, nosotros volition demand to brand some assumption for the forecast of catamenia one. 1 common assumption is to use the same need of period one for its forecast. This will give us a forecast to starting time, and then, we tin can calculate the forecast for period 2 from there. Let's meet how the calculations work out:

If α = 0.3 (assume it is given here, but in practice, this value needs to be selected properly to produce the nigh accurate forecast)

Assume F1 = Done, which is equal to 42.

Then, calculate F2 = (one – α) F1+ α D1 = (i – 0.3) x 42 + 0.3 x 42 = 42

Side by side, calculate Fiii = (i – α) Ftwo+ α Dii = (1 – 0.three) x 42 + 0.3 10 37 = 40.5

And similarly, F4 = (1 – α) F3+ α D3 = (1 – 0.3) x 40.5 + 0.3 x 34 = 38.55

And finally, F5 = (one – α) F4+ α D4 = (ane – 0.3) 10 38.55 + 0.iii x 40 = 38.985

Attainable format for Effigy iii.3

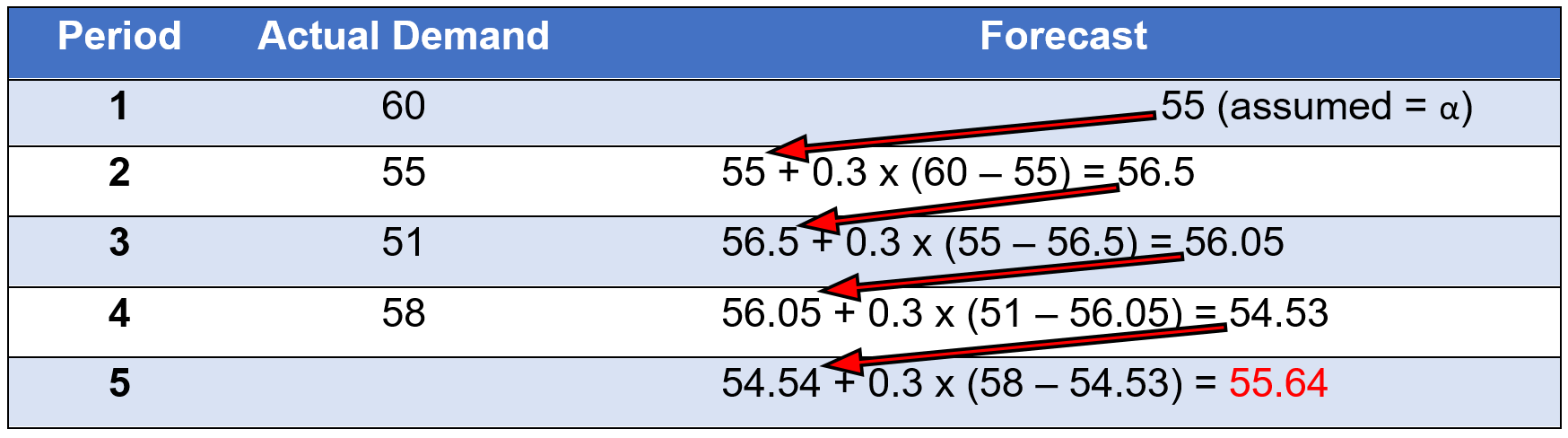

Hither is version #2:

Ft = Ft-1 + α(Dt-one – Ft-ane)

Example

Assume y'all are given an alpha of 0.three, F t- 1 = 55

Accessible format for Figure 3.4

Seasonal Alphabetize

Many organizations produce goods whose need is related to the seasons, or changes in weather throughout the year. In these cases, a seasonal alphabetize may be used to aid in the calculation of a forecast.

Case

| Flavour | Previous Sales | Average Sales | Seasonal Index |

| Winter | 390 | 500 | 390 / 500 = .78 |

| Jump | 460 | 500 | 460 / 500 = .92 |

| Summertime | 600 | 500 | 600 / 500 = 1.two |

| Autumn | 550 | 500 | 550 / 500 = 1.ane |

| Total | 2000 |

Using these calculated indices, we can forecast the demand for next year based on the expected annual need for the next year. Permit's say a business firm has estimated that next year almanac demand will be 2500 units.

| Season | Anticipated annual demand | Avg. Sales / Season | Seasonal Factor | New Forecast |

| Winter | 625 | 0.78 | .78 x 625 = 487.5 | |

| Spring | 625 | 0.92 | .92 x 625 = 575 | |

| Summer | 625 | 1.2 | 1.2 ten 625 = 750 | |

| Fall | 625 | 1.1 | i.1 x 625 = 687.v | |

| 2500 |

Forecast Accuracy Measures

In this section, we volition calculate forecast accuracy measures such equally Mean Absolute Divergence (MAD), Mean Squared Error (MSE), and Hateful Absolute Percentage Mistake (MAPE). We volition explicate the calculations using the next example.

Instance

The following bodily demand and forecast values are given for the past four periods. We want to summate MAD, MSE and MAPE for this forecast to see how well it is doing.

Notation that Abs (eastwardt) refers to the accented value of the error in period t (due eastt).

| Period | Bodily Demand | Forecast | et | Abs (et) | eastwardt 2 | [Abs (et) / Dt] x 100% |

| 1 | 63 | 68 | ||||

| 2 | 59 | 65 | ||||

| 3 | 54 | 61 | ||||

| four | 65 | 59 |

Here are what need to practice:

Step ane: Calculate the error as eastt = Dt – Ft (the deviation between the bodily demand and the forecast) for any menstruum t and enter the values in the table above.

Stride two: Calculate the accented value of the errors calculated in step 1 [i.e., Abs (et)], and enter the values in the table above.

Stride 3: Summate the squared error (i.e., eastt 2) for each menses and enter the values in the table above.

Step 4: Summate [Abs (et) / Dt] x 100% for each period and enter the value under its column in the table above.

Solution

| Period | Actual Demand | Forecast | eastwardt | Abs (et) | et ii | [Abs (et) / Dt] x 100% |

| one | 63 | 68 | -5 | 5 | 25 | 7.94% |

| 2 | 59 | 65 | -vi | 6 | 36 | 10.17% |

| three | 54 | 61 | -7 | 7 | 49 | 12.96% |

| 4 | 65 | 59 | half-dozen | 6 | 36 | 9.23% |

MAD = The average of what nosotros calculated in pace two (i.e., the average of all the absolute error values)

= (five + vi + 7 + half dozen) / 4 = 24 / iv = 6

MSE = The average of what we calculated in footstep 3 (i.e., the boilerplate of all the squared error values)

= (25 + 36 + 49 + 36) / 4 = 146/4 = 36.v

MAPE = The average of what nosotros calculated in step 4

= (seven.94% + 10.17% + 12.96% + 9.23%) / 4 = 40.three/4 = 10.075%

End of Affiliate Issues

Problem #1

Below are monthly sales of calorie-free bulbs from the lighting store.

| Month | Sales |

| Jan | 255 |

| Feb | 298 |

| Mar | 357 |

| Apr | 319 |

| May | 360 |

| June |

.

Forecast sales for June using the following

- Naïve method

- Iii- month simple moving average

- Three-month weighted moving boilerplate using weights of .five, .iii and .2

- Exponential smoothing using an blastoff of .ii and a May forecast of 350.

Solution

- 360

- (357 + 319 + 360) / 3 = 345.three

- 360 x .5 + 319 x .iii + 357 x .ii = 347.1

- 350 + .2(360 – 350) = 352

Trouble #ii

Demand for aqua fit classes at a large Community Middle are equally follows for the offset six weeks of this yr.

| Week | Need |

| 1 | 162 |

| 2 | 158 |

| 3 | 138 |

| four | 190 |

| five | 182 |

| 6 | 177 |

| 7 |

.

You have been asked to experiment with several forecasting methods. Calculate the following values:

- a) Forecast for weeks 3 through week seven using a two-period simple moving average

- b) Forecast for weeks 4 through week 7 using a iii-period weighted moving average with weights of .half dozen, .three and .one

- c) Forecast for weeks 4 through week vii using exponential smoothing. Begin with a week 3 forecast of 130 and use an blastoff of .3

Solution

| Week | Demand | a) | b) | c) |

| ane | 162 | |||

| 2 | 158 | |||

| 3 | 138 | (162 + 158) / two = 160 | 130 | |

| four | 190 | (158 + 138) / ii = 148 | 138 x .6 + 158 x .three + 162 ten .ane = 146.4 | 130 + .three x (138 – 130) = 132.4 |

| 5 | 182 | (138 + 190) / two = 164 | 190 x .half-dozen + 138 ten .3 + 158 10 .1 = 171.2 | 132.4 + .3 ten (190 – 132.4) = 149.7 |

| 6 | 177 | (190 + 182) / 2 = 186 | 182 x .6 + 190 10 .3 + 138 x .i = 180 | 149.vii + .3 10 (182 – 149.seven) = 159.4 |

| 7 | (182 + 177) / 2 = 179.5 | 177 x .6 + 182 x .iii + 190 10 .one = 179.8 | 159.4 + .3 ten (177 – 159.iv) = 164.seven |

Problem #3

Sales of a new shed has grown steadily from the large farm supply store. Beneath are the sales from the past five years. Forecast the sales for 2018 and 2019 using exponential smoothing with an alpha of .four. In 2015, the forecast was 360. Calculate a forecast for 2016 through to 2020.

| Year | Sales | Forecast |

| 2015 | 348 | 360 |

| 2016 | 372 | |

| 2017 | 311 | |

| 2018 | 371 | |

| 2019 | 365 | |

| 2020 |

.

Solution

| Year | Sales | Forecast |

| 2015 | 348 | 360 |

| 2016 | 372 | 360 + .4 10 (348 – 360) = 355.2 |

| 2017 | 311 | 355.ii + .4 x (372 – 355.ii) = 361.9 |

| 2018 | 371 | 361.nine + .iv x (311 – 361.9) = 341.half dozen |

| 2019 | 365 | 341.6 + .iv x (371 – 341.6) = 353.3 |

| 2020 | 353.3 + .4 x (365-353.3) = 358.0 |

Problem #iv

Below is the actual need for X-rays at a medical dispensary. Ii methods of forecasting were used. Calculate a mean absolute deviation for each forecast method. Which 1 is more than accurate?

| Week | Actual Demand | Forecast #1 | Forecast #two |

| one | 48 | 50 | 50 |

| two | 65 | 55 | 56 |

| iii | 58 | threescore | 55 |

| 4 | 79 | 70 | 85 |

Solution

| Week | Bodily Demand | Forecast #1 | IerrorI | Forecast #2 | IerrorI |

| 1 | 48 | 50 | 2 | l | 2 |

| ii | 65 | 55 | 10 | 56 | 9 |

| 3 | 58 | 60 | 2 | 55 | 3 |

| 4 | 79 | lxx | 9 | 85 | 6 |

| Hateful Abs Deviation: | five.75 | Mean Abs Deviation: | 5 |

What Category Of Forecasting Techniques Uses Managerial Judgment In Lieu Of Numerical Data,

Source: https://pressbooks.senecacollege.ca/operationsmanagement/chapter/forecasting/

Posted by: schmalzthretent.blogspot.com

0 Response to "What Category Of Forecasting Techniques Uses Managerial Judgment In Lieu Of Numerical Data"

Post a Comment